Jamiesfeast – A former executive of a New York real estate development firm, who is currently facing numerous challenges, has been indicted on Wednesday for his alleged involvement in a massive $86.6 million fraud scheme.

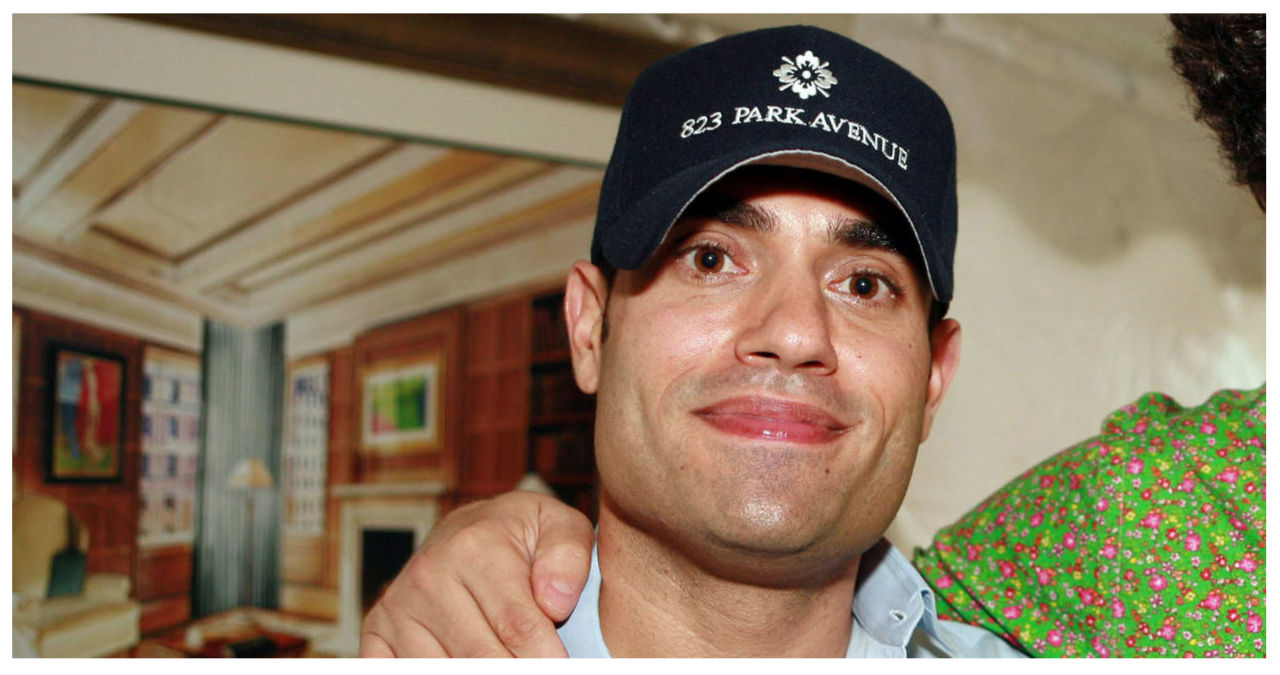

Nir Meir, a 49-year-old former managing principal of HFZ Capital Group, has been indicted on charges of tax fraud, falsifying business records, and multiple counts of larceny. It is alleged that Meir engaged in a long-term scheme to defraud investors, subcontractors, and the city.

According to New York Magazine, Meir was taken into custody on Monday night at the 1 Hotel in South Beach, where he had been residing. He entered a plea of not guilty before a Florida judge and is now awaiting extradition to New York. Prosecutors claim that Meir and his associates engaged in fraudulent activities, including fabricating construction expenses, deceiving investors, and inflating invoices to create the illusion of progress on multiple projects.

According to a statement by Manhattan District Attorney Alvin Bragg on Wednesday, the indictments outline accusations of extensive fraud in the real estate sector, with Nir Meir being the central figure responsible for orchestrating it.

Lawyers representing HFZ Capital Group and Meir have yet to provide a response to a request for comment.

HFZ, the once prominent real estate development firm in Manhattan, is facing new legal charges. These charges come as a blow to the company, which collapsed in 2020. Prosecutors claim that when HFZ’s financial troubles became public and investors sought to examine its books, Meir, the company’s director, instructed an accountant to falsify bank account statements. These statements were meant to show millions of dollars in investor funds, even though the accounts were nearly empty.

According to prosecutors, Meir allegedly instructed the accountant to inflate statements for an account, falsely claiming that it held over $24.6 million. However, in reality, the account only contained $814.

After its closure, Meir has been confronted with multiple lawsuits while residing in Miami Beach. One of the lawsuits, as reported by New York Magazine, was filed by his former business partner, Ziel Feldman. In the lawsuit, Feldman accused Meir of orchestrating a cunning plan to enrich himself through theft, deception, and manipulation. The allegations include Meir diverting millions of dollars from the company’s funds for personal gain, unlawfully taking possession of a HFZ Capital-owned property in the Hamptons, and even going as far as hiring someone to impersonate a Korean investor. Feldman’s lawsuit seeks a staggering $688 million in damages from Meir.

In a lawsuit filed in 2022 by Israeli businessman Yoav Harlap, it was alleged that Meir, instead of repaying a delinquent loan, was living a lavish lifestyle in Miami. According to the lawsuit reported by The Real Deal, Meir resided in a luxurious Miami Beach estate with his wife, indulged in chartered yachts, and even invested over $1.5 million in gold bullion, all while concealing his assets.

Last week, Meir filed for bankruptcy in Florida after Harlap obtained an $18.5 million civil judgment against him. Surprisingly, Meir claimed to have a mere $50 in cash to his name, as reported by The Real Deal. Additionally, he disclosed a staggering $30 million in liabilities.

Meir finds himself caught in the midst of a matrimonial dispute with his wife, Ranee Bartolacci. Interestingly, Bartolacci had previously claimed to be unaware of her husband’s financial difficulties. However, court documents have revealed that Meir had been borrowing significant amounts of money from Bartolacci’s father while dealing with creditors and indulging in a lavish lifestyle.